Whether you are a start-up with a brand new product, a well-established company in a seemingly stable market or a sports club facing changing social trends – no organization or other subject is independent of the developments in the outside world. Every possible subject is embedded in a certain environment and almost always influenced by external forces outside its own control. This especially holds true in business, for example when the own goals are in conflict with those of other market participants. A simple example for this would be two or more companies striving for dominance in the same market segment: the fight will be much harder than on uncontested ground – the opponents will probably not just give way but rather resort to more or less ingenious measures the others will have to deal with. Therefore, it is important to understand the structure of the environment and the important influencing factors: who are the players and forces, what is the current situation and which trends or developments can be identified? Only if the external conditions and their potential development are sufficiently understood, a promising strategy can be developed to successfully reach the overall goal.

Environment analysis with the Strategy Explorer

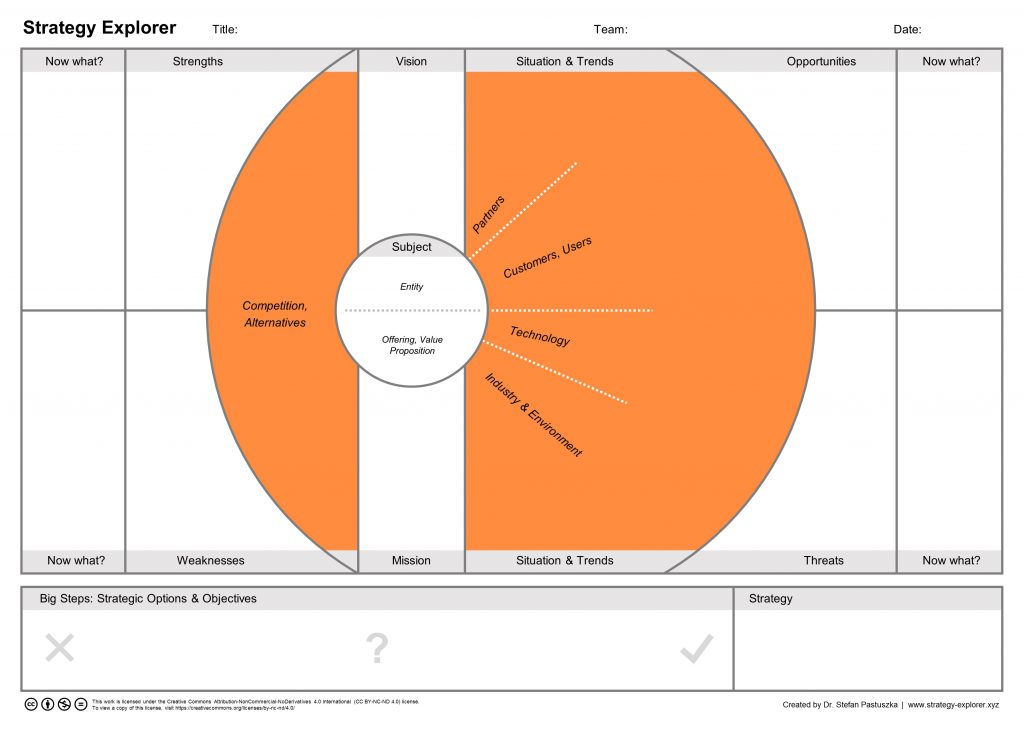

In the Strategy Explorer, the Subject field is located within a larger circular area representing the environment. This larger field is named “Situation & Trends” and forms the space where you collect the relevant observations and developments that characterize the environment of your subject.

In order to help you create a picture that contains various perspectives, the environment field is structured according to five categories, as described in the following list.

- Competitors, Alternatives: Competitors of the analyzed organization or alternatives to the offering provided. Content: Current competitors (or groups of competitors) and alternatives, potential new entrants.

- Customers, Users: Customers of an organization, buyers and users of the offering in question. Content: Specific observations and larger sociocultural trends: important customers or customer segments, situation and relevant developments/trends (e.g., buying behavior, supplier strategies, values, preferences, demography, living conditions, income), …

- Partners: Cooperation partners who help bring the business model to life. Content: Relevant partners (e.g., suppliers, service providers, distributors), situation and expected developments regarding the partners (e.g., working climate, dependencies, efficiency), …

- Technology: Technological state of the art and future development. Content: Existing and already employed technologies, new technologies (intellectual property rights, market readiness, substitution trends, …), (un-)expected developments, news from science and research, …

- Industry & Environment: Situation and important developments in the industry and the larger environment (politics, economy, ecology, legal). Content: Industry structure, consolidation trends, location, resources, growth, economy, specific regulations, legal requirements, ecological requirements, certification, sustainability, globalization, labor market, …

While comparing your own organization with others in the same context will help to identify strengths and weaknesses, the assessment of relevant observations and developments in the environment will lead to the identification of opportunities and threats. Therefore, the category “Competition, Alternatives” is placed on the left side of the Strategy Explorer, close to the fields “Strengths” and “Weaknesses”, while the other categories are found on the right hand side, leading to the fields “Opportunities” and “Threats”.

Focus on the relevant aspects

Obviously, the environment field in the Strategy Explorer is far too small to perform a full-fledged environment analysis and collect every detail here. Instead, it is important to discover and capture the most important facts and developments for the subject of your strategy development. This means that you need to focus and leave out less relevant information or secondary developments. As an example, specific regulations like FDA approval procedures are highly relevant for businesses active in drug development, while being irrelevant for most other endeavors. Which change in end-user behavior will have the most immediate or direct impact on the viability of your new product and which ones are less relevant? If you are not already reasonably clear about the most important influencing factors for your business, I recommend to have an open discussion in a diverse team and let it be inspired by the list of keywords in the list above. This discussion is also useful if you feel pretty sure about your factors as it might bring new, unexpected insights.

A general tip: if you come up with overwhelmingly many observations, try to first collect them on a separate pin-board or wall and prioritize before transferring the most important ones into the Strategy Explorer.

When entering information into the „Situation & Trends“ field, I recommend to place the observations of the current situation close to the center and the expected developments rather towards the outside. This will help you construct logical chains in preparation of the next step, the SWOT analysis.

For example, when I applied the Strategy Explorer to my own consulting business, an important observation in the area of customers was the fact that many companies‘ budgets for workshops and travel are being further reduced. I had placed my targeted customer groups close to the center of the field and noted the budget and travel trends towards the outside. In addition, I captured the continuing trend of virtualization of meetings, especially when working internationally, and placed it in the Technology area. As workshops are an important part of my work, these developments are relevant and need to be addressed. Both can be threats or opportunities – depending how they are dealt with. For me, the development of electronic alternatives and options would be the positive way to go. The logical chain of argumentation from the center to the outside is easily visible and comprehensible if the notes are placed in the described sequence into the Strategy Explorer.

Drawing conclusions

When you are discussing and filling in the relevant observations, you might already have ideas about how to deal with these. They might lead you directly to ideas for the next step, the SWOT analysis. If you have a logical sequence in your mind already, like the following

observation > expected development > opportunity,

I recommend to note the opportunity immediately instead of waiting for the environment analysis to be completed first. Otherwise you might lose an important thought. It is OK to jump in the Strategy Explorer process and follow your intuition!

Stay tuned for the next article in this series, describing the “SWOT – Now what?” step. If you need more information, get hold of the book (in German), visit strategy-explorer.xyz for more articles or contact me directly!